OnSite welcomes new Interim Managing Director

SSI Services, part of South Staffordshire Plc, is delighted to welcome Andrew Lobley as its new interim managing director of Group business, OnSite.

South Staffordshire Plc’s compliance division welcomes new sales director

Nicki will join the senior management team overseeing all aspects of sales for the two compliance businesses, IWS Water Hygiene and Omega Red Group.

New office brings compliance colleagues together

South Staffordshire Plc is delighted to announce the opening of a new office, which sees colleagues from its compliance division brought together under one roof.

One in six delayed payment of a water bill due to lack of understanding

Unclear communications and a lack of understanding of water bills are causing almost one in six (14%) bill payers to delay payment to their water provider, according to new research.

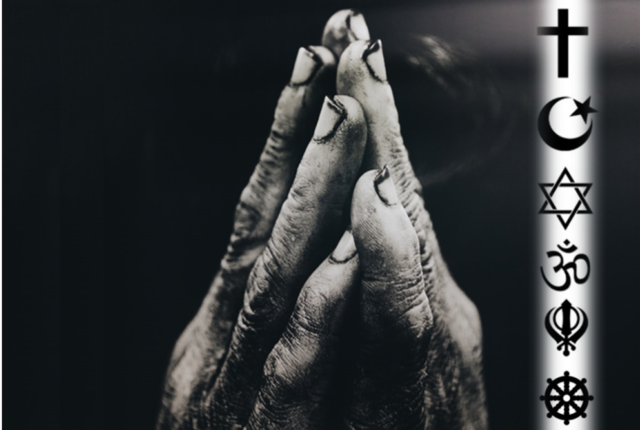

University of Cambridge reveals insight for Cambridge Water’s Water Efficiency in Faith and Diverse Cultures project

University of Cambridge reveals insight for Cambridge Water’s Water Efficiency in Faith and Diverse Cultures project, largely funded by Ofwat.

Innovative South Staffordshire Plc businesses win 2023 Utility Week Award

Cambridge Water, together with South Staffordshire Plc’s engineering businesses, have been awarded the Environmental, Social and Governance (ESG) Initiative of the Year Award.

Echo to deliver specialist customer service and new software to Northern Ireland Water

Echo has won a new contract to deliver contact management, billing, and collection management services for Northern Ireland Water.

Innovative South Staffordshire Plc businesses shortlisted for Utility Week Award

Cambridge Water together with South Staffordshire Plc’s engineering businesses have been named as finalists for the Environmental, Social and Governance (ESG) Initiative of the Year Award.

South Staffordshire Plc welcomes Barry Hayward as new CCO

Delighted to announce today the appointment of Barry Hayward as our new Chief Commercial Officer (CCO), joining us in January 2024.

Double win for Echo at the Northern Ireland Contact Centre Awards 2023

Echo NI’s team won both Customer Contact Manager of the Year and Best Outsourced Partnership at the 26th October ceremony.